Taxes and incentives

Doing business in Rotterdam means you have the benefits of local and national governments actively stimulating entrepreneurship through a competitive corporate tax structure along with financial assistance such as incentives, grants, subsidies and support programs. Are you wondering about topics such as company tax rates or capital gains tax in the Netherlands? Check the information on this page.

Competitive tax climate

The transparent Dutch tax regime offers competitive corporate income tax rates and various tax benefits. The Dutch Tax Authorities are known for their pro-active, flexible and practical approach, supporting foreign direct investment. The Netherlands Foreign Investment Agency (NFIA) provides an overview of key benefits of the Dutch tax system. Click the the topics below to read more, or download the Invest in Holland brochure via the green button:

National incentives supporting innovation and sustainability

The Netherlands offer incentives to actively stimulate investments in innovative and sustainable solutions. The Netherlands Foreign Investment Agency (NFIA) provides an overview of key incentives including (click items to read more):

Local support encouraging sustainable innovations

Rotterdam offers various incentives and subsidies to support a sustainable infrastructure and projects, including (click items to read more):

More information

If you want to know more about the favourable Dutch tax and incentives climate, here’s some official websites that may be of interest to you.

Facts & Figures

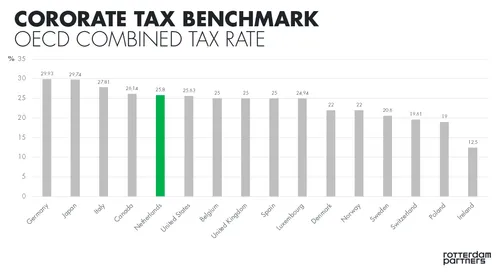

Benchmark Dutch tax regime compared to other European countries.

Source: Corporate Tax Rates by Country 2025

About us

We are the official Investment Promotion Agency for the Rotterdam region. From location advice and fact-finding trips to connecting you with partners and networks, we help you start and grow your business.